In a major leap forward for postgraduate education in Africa, Prodigy Finance has announced the launch of a $30 million Blended Finance Programme, aimed at providing greater access to international education for African students.

This innovative financial model has been created in collaboration with Standard Bank and Allan & Gill Gray Philanthropies, and is designed to support the next generation of African leaders, particularly those who might otherwise struggle to secure funding for their studies.

The programme’s unique structure allows for a highly efficient deployment of funds. For every $1 of capital provided by the philanthropies, $4 of student loans can be made available through the partnership with Standard Bank. This means that a much larger pool of students will benefit compared to traditional scholarship schemes. Additionally, the funds are designed to be self-replenishing, as proceeds from student loan repayments are reinvested to provide future loans.

The result is a sustainable financial model with the potential for broad social impact while ensuring financial returns for the bank.

“Prodigy Finance offers an innovative loan platform tailored for international postgraduate students at top graduate schools like UCT GSB,” says Prodigy’s University Relations Specialist, Jacqui Smith. “With no need for a cosigner or collateral, our loans* cover both tuition and living expenses, providing the financial support you need. Plus, no payments are required until six months after graduation, and there are no prepayment penalties, giving you the flexibility to focus on your studies and future success.”

Aligning with the UCT GSB's commitment to impact and education

The UCT GSB is excited about this new initiative. It as an important step forward in supporting talented and deserving individuals in Africa. Prodigy Finance’s programme directly aligns with the GSB’s mission to nurture a new generation of globally-minded leaders.

“We are incredibly excited to see this innovative financing solution take shape,“ says Nondumiso April Somazembe, Head of the Career Leadership Centre at the GSB. “We believe in creating opportunities for deserving and ambitious people, no matter their financial background or constraints. Prodigy’s Blended Finance programme opens doors for students who aspire to make a difference in their communities and beyond, and it echoes our commitment to fostering diverse leadership across the globe.”

She added that the GSB’s Career Leadership Centre works tirelessly to ensure that talented students reach their full potential.

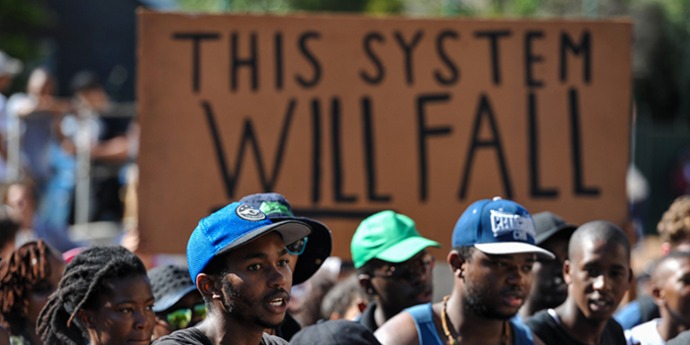

Bridging Africa’s educational and employment gaps

Africa faces several pressing challenges, including a youth unemployment rate of nearly 60%. Moreover, projections from HolonIQ suggest that three-quarters of the world’s new graduates will come from Africa and Asia by 2050. The International Finance Corporation (IFC) also highlights that addressing the digital skills gap in Africa could increase the continent’s GDP by up to 5%. Education, therefore, is more crucial than ever for Africa’s socio-economic development.

Prodigy Finance’s Blended Finance programme offers a critical solution for African students who wish to pursue postgraduate degrees at international institutions like the UCT GSB. By removing financial barriers, this initiative enables students to develop the skills and expertise needed to contribute meaningfully to their countries' economies and drive growth across the continent.

Cameron Stevens, CEO of Prodigy Finance, further underlined the importance of the programme for the continent: “We aim to unlock Africa’s untapped potential. This initiative will transform countless students’ educational and professional trajectories, fostering a new generation of leaders on the continent.”

Expanding opportunities for women in leadership

One of the Blended Finance Programme’s key objectives is to address gender disparities in access to education, particularly at the postgraduate level. By increasing the number of women pursuing advanced degrees, Prodigy Finance hopes to contribute to a more inclusive workforce and a rise in female leadership across various industries.

The UCT GSB, as a leader in promoting gender diversity and inclusion, is particularly excited about this focus. At the GSB, empowering women in leadership positions is central to the institution’s educational ethos, and the Blended Finance programme is poised to create new pathways for aspiring female leaders.

A shared vision for the future

Looking ahead, Prodigy Finance plans to expand the Blended Finance programme to $200 million over the next three years, amplifying its reach and transformative potential. The UCT GSB remains committed to working with partners like Prodigy Finance to ensure that the brightest minds from Africa can access the resources they need to succeed on the global stage.

“The GSB is excited about the potential of Prodigy’s new programme to shape the next generation of African changemakers,” says the GSB’s Director, Dr Catherine Duggan. “This shows how innovation in financial structuring and the power of philanthropy can work together to create long-term, sustainable solutions that empower students to learn, to lead, and to make an impact on the world — no matter where they come from or their financial constraints.”

“The best advice for students is: first check your eligibility, apply early and provide accurate information in your application, and definitely utilise the Prodigy Support via chatting with a mentor and using the study centre,” says Jacqui Smith.

As UCT GSB and Prodigy Finance continue to foster and develop postgraduate education, the future looks brighter for the continent's future leaders.

To apply for the Prodigy Finance Blended Finance Programme, click here.

*Loan and promotion offers are subject to our eligibility, funding, and credit assessment criteria. Loan amounts are subject to the cost of attendance limits set by schools. Representative APR 13.35% variable. APR includes interest + mandatory fees (All-inclusive rate of borrowing). Prodigy Finance Ltd is authorised and regulated by the Financial Conduct Authority in the United Kingdom.