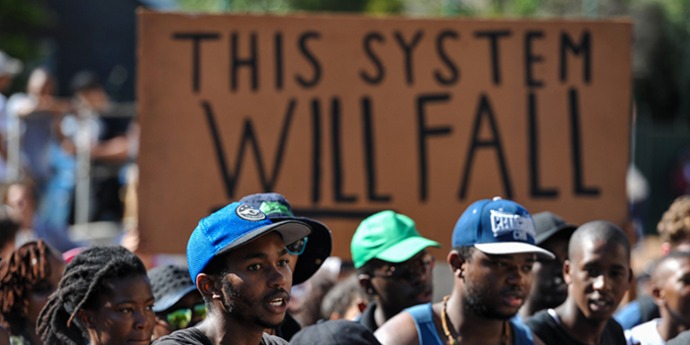

Dean Hand remembers the early days of impact investment in South Africa, when she had to pitch for novel funds she was helping to set up and was told outside the conference room door not to put the words “impact” and “investment” in the same sentence for fear of scaring off mainstream investors. “We have come a long way since then!” says the former Impact Investment Strategist at Ashburton Investments from her current office in New York, where she works as Chief Research Officer for the Global Impact Investing Network (GIIN). The GIIN is recognised as one of the world’s leading sources of data and insight on impact investment, bringing out prestigious annual reports on the state of the sector. It may seem like she is a long way from home, and South Africa, in particular. But Dean does not see it that way. It only happens to be that the fight for social justice and the needs of the impact investment field have taken her to the US. “In a sense I never really left the country. It’s more about where I can make a significant contribution and that is here right now.” Dean has always been driven by a need to make a difference. Raised in apartheid South Africa, she was part of the anti-apartheid movement; following undergraduate studies in industrial psychology, she started working for NGOs before extending her impact investment work in mainstream financial institutions. Frustrated by the challenges in the sector and the aspiration to influence systems change across the financial markets, she enrolled in the MPhil in Inclusive Innovation at the UCT Graduate School of Business (GSB) in 2017 which proved instrumental in shifting her perspective. “I think this was where my eyes were opened to how I could make the kind of impact I wanted. Doing the MPhil was pivotal for me on so many levels.”

Dean’s master’s thesis looked at the role of endowed foundations and the need for more awareness, better data and statistics to drive the social impact investment agenda. While at the GIIN, she has been instrumental in helping to develop a crucial benchmark for financial services, and inclusion specifically. The network is currently working on another benchmark for agriculture. Based on metrics that investors have prioritised, these benchmarks use key performance indicators, to evaluate whether an investment has been successful relative to a threshold of impact performance that is needed to solve for specific Sustainable Development Goals. The benchmarks have been widely welcomed by the impact investment community. “There has been a hugely positive response,” says Dean. “In our market analysis, most investors told us they were worried about impact washing (where false or misleading information is provided around a company’s social investment policies) and being unable to compare their performance or establish how their investments were performing exactly.” The GIIN welcomes the development of more disclosure based policy and regulation such as the EU taxonomies that help prevent impact washing. But this is a small part of a sector where a lot of good things are happening, says Dean.

“We are definitely seeing significant capital flowing into social impact investments and there is a lot of development in this area.” She refers to the fact that in 2021, global sustainable funds recorded a record high of $3.9 trillion, doubling over the past year. “We have seen many companies and private investors really concerned about COVID-19 and wanting to address the dire situation of communities and individuals around the world.” She adds, “I think COVID-19 has highlighted so many inequalities and failings in various systems. It has highlighted how vulnerable we are. For many, it has been an opportunity to think more effectively about change for people and the planet.” While a lot has been achieved, she believes that much still needs to be done. “I want to think I am helping to leave the world a better place than I found it and through my work – I feel I am contributing to that goal.”