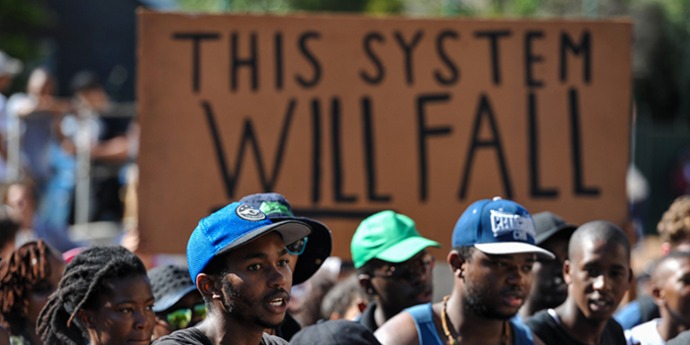

The COVID-19 pandemic has irrevocably altered the field of South African wine, surfacing existing fault lines under immense strain. Bold leadership could not be more pressing.

There are arguably few industries that have borne the brunt of the pandemic to the extent of South African wine. Three separate alcohol bans, a 5-week hold on exports, and restrictive sales and consumption policies have seen the wine industry lose upwards of R7 billion, according to VinPro — a conservative estimate, as others have put that number closer to R25 billion. Additionally, VinPro estimates that around 21,000 jobs will be lost across the value chain in the aftermath. Soberingly, many of the challenges now confronting South African wine were not caused by the pandemic. Rather, COVID-19 served as a catalyst to widen already existing cracks within the industry.

Cracks in the façade

A major fault line is the ongoing discounting of South African wine. While wine is South Africa’s second largest agricultural export — raising questions concerning government support — apartheid sanctions resulted in constraining quality innovation, leading international wine markets to label South African wine as “cheap and cheerful” in the 1990s, a stigma the industry is still struggling to overcome. Packaged wine is often exported at R43 p/l on average and bulk wine sometimes less than R4.50 p/l, making South Africa one of the cheapest mainstream exporters of wine in the world without the volume to sustain such a strategy. When comparing the trajectory of export prices, other New World countries have experienced significant growth. Australia, whose export levies are matched by government, jumped from $1,54 per exported packaged litre in 1990 to $4,64 in 2019, while Chile went from $0,98 to $3,16. By contrast, South Africa has barely increased its price p/l by 80 US cents within that time. Locally, 82% of packaged wine is sold for less than R48 p/l.

The South African wine industry cannot afford to carry on like this. Failure to address these unsustainable prices will make it impossible to achieve true social inclusion, as transformation is best advanced in an industry that has the equity to drive social growth.

Adversity inspires innovation and creativity

Despite this challenging backdrop, wine businesses have nonetheless shown great creativity and innovation throughout the pandemic. A surge in online trade has seen global alcohol ecommerce increased by 234% compared to the previous year, according to Nielsen. South Africa is no exception. Wine.co.za has been operating its online shop since 2009, launching its direct-to-consumer platform, CellarDirect, in 2019. “During the alcohol ban the orders went absolutely crazy for both platforms — and during May orders ballooned from 150 monthly orders to over 6,000!” says Judy Brower of Wine.co.za. CellarDirect's income increased from an average of R20k per month to about R800k — R1million per month, after May 2020 hit a peak of R4 million.

Wine exports, too, have proved resilient. Exports are responsible for 45% of South Africa’s wine sales and despite 2020’s earlier export ban, export volumes by the end of the year bounced back to 2019 levels at 319 million litres. This is due to the fortitude of winemakers, a fortuitous trade dispute between China and Australia that has opened up a gap for South African wine, and a global social media campaign (#SaveSAwine) encouraging international wine lovers to support Brand South Africa.

"The South African wine industry has always been a particularly challenging, and risky industry and this has both bred and required the high level of resilience and innovation we see in South African producers,” says Anthony Hamilton Russell of Hamilton Russell Vineyards. The pandemic forced many to re-think a reliance on wine clubs and direct sales to visitors. Those who survived best had highly focused ranges and well-developed export markets in numerous countries — both on-trade and off-trade. “I fully expect these troubled times to lead to more producer product focus on the ‘winners’ in their range, and a far wider international target audience," says Hamilton Russell.

Bold leadership needed to steer South African wine to a sustainable future

If there’s one thing the wine industry has learnt from the disruption of 2020, it’s that it can no longer take traditional wine sales for granted. Never before has it been as pressing that all wine-related businesses have highly adaptable business models to survive and flourish. To foster this culture, it will be up to educators and industry leaders to skill wine professions. South Africa’s recent quality track record is testament to the work that has been put into technical skills. However, while wine production practices will forever be core facets of the wine industry, quality alone is not enough to succeed. This sentiment is echoed by WOSA’s Africa market manager Matome Mbatha: “WOSA’s strategic position is to drive premiumisation of South African wine.” In terms of wine education, he goes on to emphasise the importance of upskilling wine professionals in improving the status and value of the country brand.

The industry needs critical and creative thinkers, across the board, to drive South African wine towards a sustainable future. This will include improving a collective dialogue with the government to overcome polarised positions. Only then will we have true resilience to withstand the uncertain future ahead.

Jonathan Steyn is convenor of the Business of Wine programme at the University of Cape Town Graduate School of Business (UCT GSB). Raphaela van Embden is an alumnus of the Business of Wine and winner of the Veritas Young Wine Writer of the Year 2019.