A team of students from the UCT GSB has won the Security Analysis Live Pitch Competition, part of the 2019-20 Global Network Investment Competition which is sponsored by the International Center for Finance at the Yale School of Management.

A total of 24 teams from 16 Global Network schools selected portfolios of stocks from their home markets. For the Security Analysis Live Pitch Competition, each team submitted a written pitch for one stock in its portfolio; four finalists, also including teams from the National University of Singapore Business School and FGV Escola de Administração de Empresas de São Paulo, were selected by the judges to make their pitches live.

In a live virtual event, the team of David Rabinowitz, Thinesh Vittee, Curtis Ray, and Asanda Manina pitched the stock of Clicks Group Ltd., the retail-led healthcare group, to a panel of investment professionals acting as judges.

Speaking after the win, Thinesh Vittee said, “It was such a fun experience. I thoroughly enjoyed collaborating with my team mate who was in Canada while Curtis and I are on Exchange in Chicago, to prepare for a competition hosted by Yale with judges and competitors in Singapore, Brazil and China! It was a truly global experience - I learnt a lot from my team and from the judges.”

Vittee said it was clear to the team that they are receiving a truly world-class MBA at the UCT GSB. “David, who led the team, used some key evaluation metrics that he was exposed to on the Company Evaluations elective. This combined with our understanding of the vital importance of a clear investment thesis, which Curtis and I gained from our Advanced Finance and Social Finance electives, are what I believe helped us stand out from our competitors. I also enjoyed that we were able to pull together quite a complex and technical presentation, and prepare for it with very little time, and still deliver a prize-winning performance. The UCT GSB has certainly expanded my capacity.”

He added that the next challenge is to decide what the most fiscally sensible thing would be to do with his share of the cash prize.

“I thought it was an excellent presentation,” said judge Michael Alpert, a portfolio manager at Stralem & Company. “I really liked how they opened by discussing what it was that they were looking for, what their criteria was, and how they got to this stock.”

Alpert’s fellow judges were Adam Abelson, chief investment officer at Stralem & Company, and Eddie Tam, a graduate of the Yale School of Management and CEO and chief investment officer at Central Asset Investments. Tam has served as a judge for each of the five annual Global Network Investment Competitions.

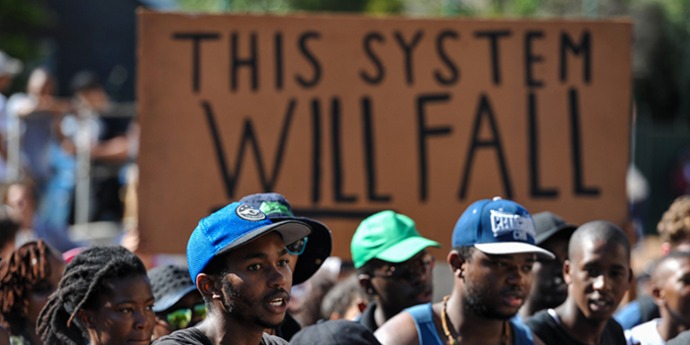

Second place went to Wujiaochang Alliance, a team from Fudan University School of Management, which pitched the stock of Jereh Oilfield Services Group. China’s measures against coronoravirus were apparent in their presentation: members of the team connected individually from their homes rather than gathering together to join the videoconference.

The Global Network Investment Competition will also present a performance prize to the team with the highest return relative to the performance of its home market over the six-month duration of the competition.