MBA alumna Dr Susan de Witt is making a name for herself in an innovative area of impact investing, which has the radical potential of raising much-needed finance while also driving social and environmental benefits in Africa.

Dr Susan de Witt has always felt a responsibility to contribute meaningfully to South Africa’s development. Aware of her privilege, she lives by the maxim: to whom much is given, much is required.

She changed the trajectory of her career to fulfil this deep sense of purpose and is now rapidly making a name for herself in the area of innovative finance. Most recently, she received a UCT Vice Chancellor’s Global Citizenship Award for her work on Social Impact Bonds — an innovative finance mechanism that raises capital for developmental projects based on their outcomes. The project in question — a first in the global south — attracted public-private investment for early childhood development services in underserved communities of Atlantis and Delft.

“An investment in ECD — the first five years of a child’s life — has been shown to yield higher returns in terms of human development than the equivalent investment in primary, secondary or even university education,” comments de Witt.

It’s quite a change from eight years ago, when she was running her own veterinary practice in Cape Town. Having worked as a vet for 12 years, both in the UK and in South Africa, she came to the realisation that her future lay outside of the profession.

“I became more interested in development and started spending a lot of my free time pursuing that through reading and volunteering. I decided I had a career change in me and after a year investigating what that could be, enrolled on the MBA at the UCT Graduate School of Business (UCT GSB) in 2013.”

Even though the UCT GSB has a strong focus on sustainable impact in African business and society, an MBA is not the obvious route for a career in social and international development. But, says de Witt, it is an excellent choice for anyone considering a career change: “I wanted to upskill in a way that was fast, that afforded maximum access to networks, and which took into account my transferable skills.

“The MBA draws on a very wide knowledge base and when you’ve been specialising for many years — as I had — that is very beneficial. You’re exposed to what’s going on in the world — government, business, civil society — and it’s completely immersive. It lifted my vision and gave me the confidence to take an ambitious step.”

It turned out to be not just a career-changing move, but a life-changing one. Relationships forged with the Bertha Centre for Social Innovation and Entrepreneurship during that year led to an opportunity to work there full-time — and a chance to carve out a new role in what remains a niche and under-skilled area of development finance in South Africa.

De Witt’s role as Outcome-based Contracting Lead sees her working with National Treasury, government and private investors to raise funds for development projects that have both a financial and a social or environmental return on investment. Her initial responsibility was to develop Social Impact Bonds (also called pay-for-impact bonds) — the work she and colleague Barry Panulo were recognised for in November.

“To set up an outcomes-based contract like this you need to finance it upfront somehow. An NGO cannot wait until the end of the contract to be paid, so we raise philanthropic investment to cover the working capital requirements in advance. And government pays at the end based on results.”

It’s a tricky arrangement to get off the ground, with a dizzying number of stakeholders to satisfy, but de Witt is well suited to these sorts of negotiations. “Through my time volunteering, I realised my strength was not at the coalface of development, but probably at a systems level.”

That’s where she’s operating now — and reaching ever higher spheres of influence. She’s currently leading the Secretariat of the National Taskforce for Impact Investing and helping South Africa prepare for the Global Steering Group Impact Summit in September — the first time it will be hosted on African soil.

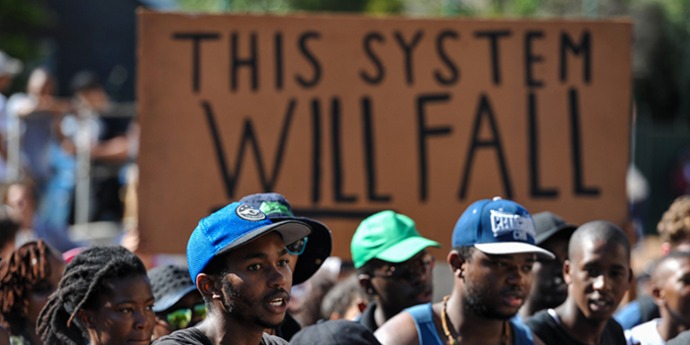

Impact investing promotes investments that not only generate a financial return, but deliver positive environmental and social outcomes as well and South Africa was the first African country to join the Global Steering Group back in 2018.

It’s been an unconventional journey to get here, but de Witt feels that she has found her niche in helping to address the “inequality, the injustice and the poverty on my doorstep.”

“It is becoming increasingly clear that economic growth on its own is not going to be enough to lift South Africa out of the doldrums. We need new business models and innovative investments that also address our social and environmental injustices if we are to move money at scale — and sustainably,” she says.