Financial literacy is low among South Africans, and the country is paying the price in many ways, says UCT Graduate School of Business professor, Mark Graham. But with even a bit of basic training the world of finance can be deciphered and embraced.

When you hear of financial mismanagement, very often the story is about a rogue leader (think Marcus Jooste of Steinhoff) or a small group of executives who, with cunning and avarice, have conspired to deceive their stakeholders and brought about catastrophe.

But for every captain of industry prepared to break the rules and cook the books in order to feather their own nest, there is a slew of others who apparently didn’t see the icebergs dead ahead.

In his riveting books, Michael Lewis — author of financial bestsellers like Boomerang, Liar’s Poker, and Panic — takes a special delight in the ignorance of CEOs and government leaders, specifically in how little they understand the spreadsheets of the multi-billion dollar businesses and budgets they steer. In Boomerang: Travels in the New Third World, for instance, he tells of how in 2009 the Greek finance minister and his accounting office had to clinically piece together, after the fact, the debt that had driven their country to the brink of disaster. Among the oversights was a ballooning government pension debt that everyone kind of knew existed, but nobody had noticed had not been accounted for every year.

According to some, the Greeks had managed their economy much the same way many of us handle our household income over the festive season. “The way they were keeping track of their finances—they knew how much they had agreed to spend, but no one was keeping track of what he had actually spent,” Lewis quoted one International Monetary Fund (IMF) official in summing up the collapse.

Accounting disasters like this occur in organisations of every scale. Just recently we read of how the Western Province Athletics Association figured out their books had allegedly been cooked only after their finance officer suddenly disappeared. And reports of fraud at schools abound, notwithstanding the supposed oversight of School Governing Boards (SGBs). “Financial mismanagement means the school’s governing body is not doing its job efficiently,” observed Professor Labby Ramrathan of the University of KwaZulu-Natal in one article.

How is it then that businesses, government departments, schools and other institutions often miss the obvious when they have access to all financial documentation? The answer is very straightforward: most don’t know what they’re looking at when confronted with a balance sheet or a financial report.

Studies by the Human Sciences Research Council and the Southern Africa Labour and Development Research Unit (SALDRU) found that, on average, South Africans have a middle-of-the-range score when financial literacy is measured. Both studies point out, however, that measuring financial literacy is complex, and that there is substantial variation by age, education, province and race.

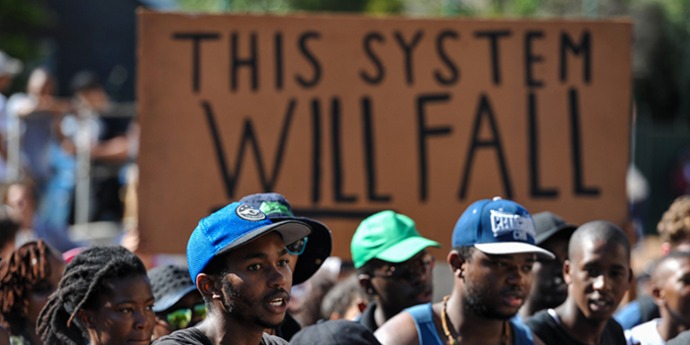

Low levels of financial literacy in South Africa have a lot to do with our country’s messy history. We also know that we’re not disciplined savers, and few have planned for their retirements. Too many South Africans live hand-to-mouth existences, too consumed by surviving to think ahead. And our education system has left most of us ill-equipped to handle or even understand basic financial documents. On top of that, issues of language and context render the management of institutions unintelligible or alien to many of our citizens.

South Africa clearly has ground to make up, especially as we seek to democratise our institutions. Board members — be they associated with the public or private sectors, or serving with non-profits — require some level of financial literacy if they are to ensure the financial sustainability of the organisations they steward. And what of entrepreneurs, often expected to drive South Africa’s economic revival? Too many studies suggest that financial literacy is low even among entrepreneurs, and they lack an understanding of the finance fundamentals that would allow them to make a success of their ventures. “… the ability of an individual to start businesses, in particular, is impacted by their financial knowledge and understanding,” wrote the authors of the above-cited HSRC report. “Indeed, it could be argued that increasing financial literacy will help increase entrepreneurship among South Africans,” they continue.

And contrary to common misconceptions, basic accounting is not rocket science. To understand a balance sheet you don’t need to be an accountant, or a whizz at finance. My own experience of teaching financial literacy to non-financial personnel — my classrooms include everyone from entrepreneurs to first-time managers — has found that becoming financially literate is about first becoming comfortable with the language of finance. With a bit of basic training, it’s a world that can be deciphered and even embraced.

The benefits of financial literacy to a country are manifold. From helping households manage their budgets and savings to enabling entrepreneurs to get on with the business of value creation and economic growth. And of course, empowering managers to recognise and call out financial mismanagement before the ship slams into the iceberg.

Those who feel comfortable with numbers are more likely to participate in the wider economy, be it as entrepreneurs, engaged employees and managers, or investors. And even as much-needed custodians of our institutions. That’s good for both our bank balances and our democracy. Increasing average rates of financial literacy could go a long way towards starting to create the capacity to boost our country’s flagging prospects.

Associate Professor Mark Graham convenes the Finance for Non-Financial Managers programme at the University of Cape Town Graduate School of Business (UCT GSB).