From Addis Ababa to Accra, Lagos to Lusaka, ground-breaking examples of Africa's agility and innovation in impact investments are flourishing. The steady growth in this asset class, however, belies a fragmented playing-field. To bring impact investing centre-stage, knowledge sharing, unity of message, more conducive regulatory frameworks and regional advocacy are key.

As Africa battles the economic crisis brought about by the COVID-19 pandemic, the value of impact investing has been further uncovered. Impact investments are investments made with the intention of generating positive, measurable social and environmental impact as well as a financial return. They have steadily gained traction across Africa in the renewable energy, housing, health care, SMME finance, agriculture and education sectors. The pandemic has forced a creative rethink around social investments, especially as social businesses are often thrust into the role of first responders and have been able to demonstrate the value of their approaches.

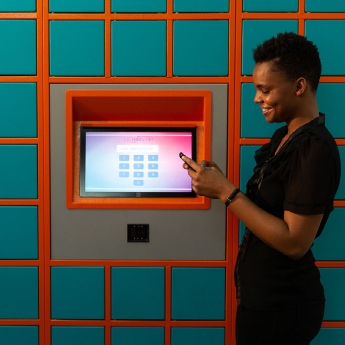

For example, in South Africa, Pelebox, a digital platform that manages an internet-enabled smart lockers, allows patients to collect their repeat chronic medication in under two minutes instead of queueing for hours at public clinics. In Zambia, where access to financing by SMMEs has traditionally been difficult, a new scheme, in part a response to the pandemic, has been initiated between the Zambian National Advisory Board for Impact Investment (NABII) with the Central Bank to plough investment into the agricultural sector. CEO, Andrew Kazilimani, says that by mid-2021 agreements for investments including initial projects in value chains like honey (production to distribution and sales, onions (production and export), as well as poultry are close to being finalised.

Shining pockets of social entrepreneurial success are found too in Ethiopia — a country plagued by developmental challenges. Kibret Abebe, a former nurse anaesthetist and II National Advisory Board member is the founder of Tebita Ambulance, which he established in 2008 after witnessing a disproportionate number of road deaths due to Ethiopia’s lack of ambulance services. The company, Ethiopia’s first private ambulance service, has treated more than 65 000 people and trained another 45 000 in emergency first response. For Kibret, one of the most exciting parts of running Tebita today is not only saving lives, but also providing fellow Ethiopians with employment.

In Ghana, Amma Lartey, CEO of Impact Investing Ghana, says many new financial innovations have been in response to the COVID-19 pandemic, such as targeted technical assistance programmes being offered alongside loan products. Special women-based products, involving an adjustment in Ghana’s traditionally high interest rates, aim to make catalytic investment more attractive to local women-led and women-focussed SMMEs.

The Global Impact Investor Network’s 2020 survey shows that 43% of impact investors have funds allocated to Africa, with 52% of investors surveyed planning to increase their Africa exposure in the next five years. The continent is fertile ground for this approach; its big developmental challenges can be solved in scalable and sustainable ways, leveraging financial institutions and governance mechanisms.

Despite the promising sparks of activity, the market is fragmented and at different stages. More developed countries are able to move faster and further. For example, South Africa’s large financial institutions such as Old Mutual, Sanlam and most major banks, have very deliberate impact investing strategies. The Public Investment Corporation (PIC), the largest institutional investor, has R2 trillion deep pockets and a clear impact investing strategy too. South Africa has also seeded some of the global south’s first social impact bonds, such as the launch in 2018 of the Impact Bond Innovation Fund (IBIF), an innovative financing mechanism that represents the first social impact bond focused on Early Childhood Development (ECD).

In Nigeria, Africa’s largest pre-COVID19 economy (according to the most recent World Bank data), the rise and rise of the mighty ‘fintechs’ has unleashed a wealth of innovative products and services, including Paystack, Flutterwave and PAGA. Maria Glover, Projects Lead at the Impact Investors Foundation, singles out PAGA as one of the most successful impact investing stories in Nigeria. Out of a population of 200 million people, PAGA, a mobile money platform, has 17 million clients. Delivering financial services to Nigeria’s unbanked and remote populations, it not only solves the issue of financial exclusion but also provides employment for over 25 000 of its agents and saves the average user US$24 in transaction costs.

What then, can be done to nudge Africa’s burgeoning impact investing sector to the front and centre of the continent’s developmental agenda? For one thing, measuring and monitoring the impact of these investments - jobs created, lives changed, people uplifted out of poverty - is key. Collaboration - speaking about and sharing information with continental partners - is also important to ensure a stronger, more unified voice to attract and retain capital. It’s a view shared by Zambia’s Andrew Kazilimani.

“Stakeholders on the ground are currently fragmented, running their own agendas and targeting the same SMMEs. Zambia needs a shared platform and shared action plan so that key players in our financial eco-system can work together and build a narrative for II in the country.”

He’s also optimistic about a shared agenda at country and regional level, such as Zambia’s cooperation with South Africa and Ghana.

In some regions, like Ethiopia, a restrictive regulatory environment is blocking the advancement of social enterprise. In the case of Tebita, foreign investors have not been allowed to invest in the service as the Emergency Medical Services sector is forbidden to foreign investors. Implementing laws, policies and procedures for social enterprise, where needed, will create an enabling environment for impact investing success in Africa.

A concerted effort to engage Development Finance Institutions (DFIs) is also critical for success, as well as taking advantage of the vast regional power that can be harnessed by sharing knowledge, broad networks of expertise and the many and varied success stories that illuminate the impact investing sphere in Africa. By joining the dots and getting all players in the investing and social impact field to work together better, impact investments can begin to unleash Africa’s immense socio-economic power.

Misha Morar Joshi is the Secretariat Co-lead at Impact Investing SA and a senior project manager at the Bertha Centre for Social Innovation and Entrepreneurship, a specialised centre at the UCT Graduate School of Business. Shiluba Mawela is the Secretariat Co-lead at Impact Investing SA. This article was informed by interviews with heads of the Impact Investing National Advisory Boards of Ethiopia, Ghana, Nigeria, South Africa, and Zambia. Impact Investing SA, along with the GSG, will be co-hosting The GSG Global Impact Summit that takes place on 6-8 October 2021.